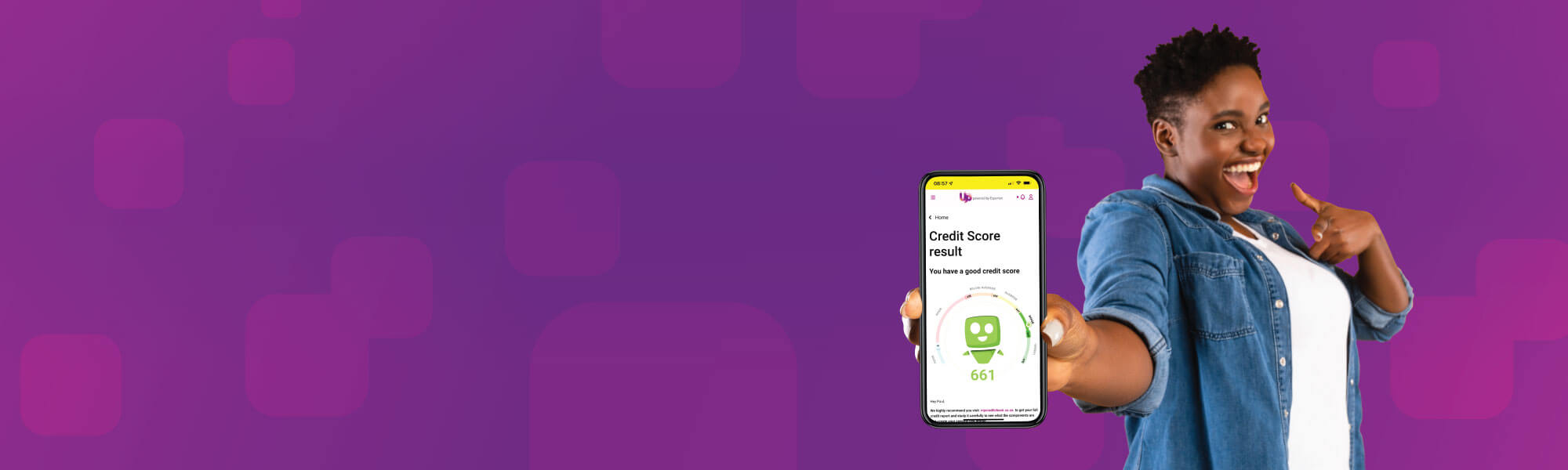

Up Consumer Credit app

Experian is committed to improving financial inclusion, financial health and fair access to credit.

We have created a tool to make this a reality for all South Africans.

We call it Up.

Up is a progressive web app, that enables consumers to stay financially savvy.

Up offers consumers immediate and secure access to their personal credit report, a budgeting tool, and a host of educational content – all at no cost to the consumer.

Register here for freeProtecting yourself against Identity theft

Identity theft is when someone steals your personal information or possessions, so they can use your identity. Identity fraud is when they use your identity for their own financial gain – usually at a great cost to you. You might not even realise that your information has been stolen until after the fraud has happened and only find out when a bill arrives for something you didn’t buy, or when you have trouble taking out a credit card or a mobile phone contract. According to research from Experian’s Victims of Fraud team, it takes an average of 292 days for people to discover their information has been used for fraudulent purposes.

How to protect your identity against fraud

Let us be your co-pilot

You should check your credit report regularly to ensure it is up to date and reflects your credit track record accurately. You are entitled one free credit report per year.

Your risk profile

Inaccurate information could paint a picture of your financial health that is not true.

You have a right to log a dispute and challenge the information on your credit report should you believe that it is incorrect. Experian has 20 business days to investigate and provide a response.

You are encouraged to take advantage of the free annual service provided by credit bureaux, as prescribed by the National Credit Act, giving consumers the right to access their credit reports once a year at no cost.

Get handy tips on understanding your credit report

At Experian we encourage you to keep a regular check on your credit report to ensure all the information is accurate.

A credit report is not only about keeping track of your credit reputation, it can assist you with budgeting and protecting your personal information against identity fraud. The report summarises your financial behaviour such as whether you regularly pay the full instalment on your accounts and on time. Inaccurate information could paint a picture of your financial health that is not true.

We encourage you to take advantage of the free annual service provided by credit bureaux, as prescribed by the National Credit Act, giving you the right to access your credit report once a year at no cost. Visit and register at www.up.Experian.co.za for your free credit report.

You have a right to log a dispute and challenge the information on your credit report should you believe that it is incorrect. Experian has 20 business days to investigate and provide a response.

To challenge information on your credit report, visit Up powered by Experian, register and submit your dispute through the portal.

You can also chat to Ed our chatbot on the if you need more information.

Get StartedReady to get started?

Register on Up, Experian’s progressive web-based app to get your free Experian credit report and score

View your credit history, current payments and balances and score credit through one user-friendly dashboard.

Register on Up