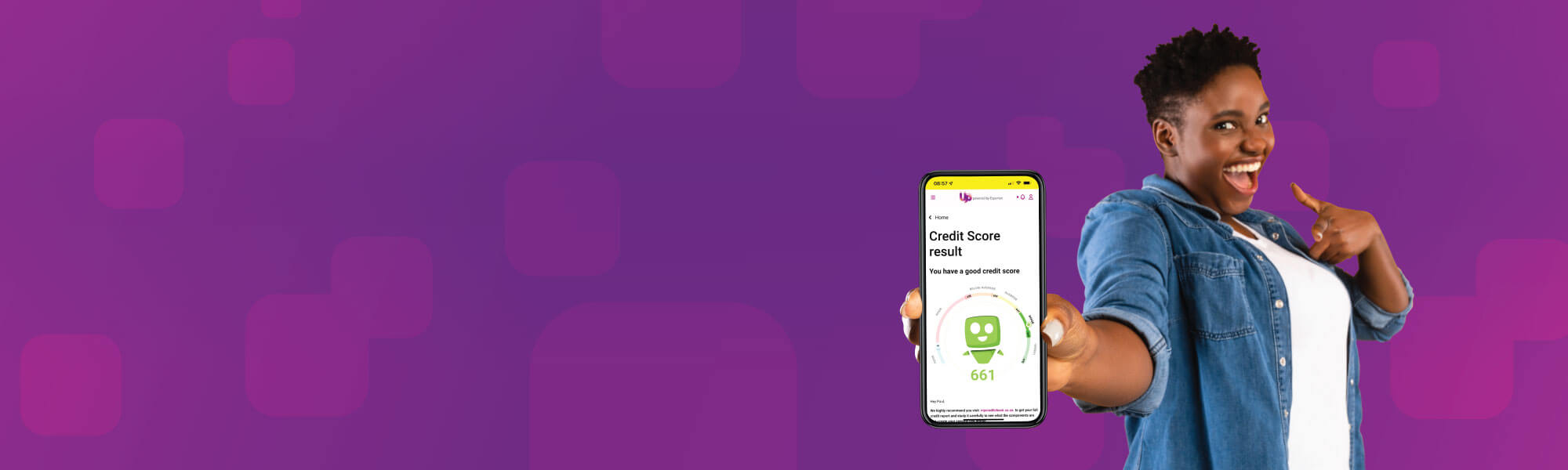

Getting your free credit report and score

Experian provides free credit reports and free credit scores on Up, Experian’s progressive web-app. This is an easy-to-use application that enables all South African citizens with valid South African ID numbers to access their credit information via their personal extensive credit reports. It also enables you to dispute any inaccurate or incorrect information on your personal credit report.

Whether you are a first-time credit report user or not, Up powered by Experian will help you understand your credit data, show you how to monitor accounts, manage debt, and improve your credit profile.

Up powered by Experian is available at www.up.experian.co.za.

You may also chat to Ed our chatbot who can assist you.

What is a free credit report?

Up powered by Experian generates full free credit reports which provides a comprehensive records of your financial history, detailed information on your borrowing and spending habits, payment trends and contact details. Information includes accounts you opened, payments you’ve skipped, judgments taken against you and what you owe your creditors.

Why should you view your free credit report?

Experian’s free credit reports were designed to help you keep up to date with your financial status by doing a Credit Bureau check. With helpful tips and easy steps, you can now get your finances in order.

Where does the information on your credit report come from?

The data included in Experian’s free credit reports comes from credit providers you have borrowed from. Whether it’s a clothing account, a loan from the bank, or cell phone contract, all credit data gets sent to registered Credit Bureaus, like Experian, which enables Credit Bureaus to do Credit Bureau checks.

How does your Experian Credit report look?

Each of Experian’s free credit reports includes your credit score and payment behaviour in a simple and easy-to-understand format. Information is grouped for you to see which activity has the biggest impact on your credit score and finances. The free credit report is an in-house Credit Bureau check.

We have included quick tips to explain the data and give you advice on how to better manage your credit. On the dashboard, you will be able to see an overview of your credit report – you don’t need to spend hours sifting through a lot of data.

Experian’s free platform application includes:

- Your personal details

- Your credit portfolio

- Payment history and behaviour

- Budget planner

- Your contact and address information

- Your perception of your position within the credit market

- Negative information including notices, defaults, judgments and debt collections

- Online dispute submission function

What is your free Credit Score?

Your credit score is the single most important financial score you’ll ever get. Yes, it’s even more important than matric aggregate, body fat count, or golf handicap, since credit providers use this credit score when deciding whether to extend credit to you. So be sure to maintain a good track record!

Your Experian credit score is calculated via a Credit Bureau check, using information from your full credit profile. Experian evaluates all your accounts, your negative and positive information, and your payment history to assign you a credit score of 0–999. The higher your credit score is, the better your credit profile, and the lower your risk will be of defaulting on an account or loan would be.

Why trust your credit score?

The Experian credit score is derived from a consumer’s personal information as submitted to Experian. This includes data on borrowing, charging and repayment activities. A credit score summarizses a number of positive and negative factors that aim to predict how likely you are to honour your credit commitments in the future.

Key information used to calculate your credit score includes account information (personal loans, credit accounts, other loans), public records, such as judgments and administration and sequestration orders. Information such as race, gender, where you live and marital status are not used in calculating credit scores.

Your credit report

A favourable credit report helps you reach your financial goals while poor credit reports and credit scores limit your financial opportunities. Since your credit report could influence whether you are able to buy a home or get any kind of credit, it is extremely important to protect your credit score by making loan and account payments on time and not taking on more debt than you can handle.

Credit and Financial Education

Experian’s Up web-based app is also a financial education resource for consumers in South Africa with a focus on savings, budgeting, credit checks, credit reports and credit scores.

My free report and score – Frequently asked questions

Experian offers South African consumers free unlimited access to their Experian personal credit report and credit score.

Step 1:

Visit www.up.experian.co.za

Step 2:

Register and submit your verification documents (ID and Proof of residence not older than 3 months)

If you are need more information, you can also chat with Ed our chatbot

Your credit report that is provided via Up can’t be viewed by just anyone else, unless you share it with them! The information contained in your credit report is confidential, and companies and individuals who wish to view your report may only do so for a prescribed purpose. The National Credit Regulator (NCR) has set out specific guidelines in accordance with the National Credit Act (NCA) that deal with prescribed purposes. Experian prides itself on protecting your privacy and we always comply to the regulations provided by the NCR.

Your free credit report is not usually a deciding factor on whether you’ll get a job. In fact, according to the Employment Equity Act of 1998, potential employers may not deny you a job on the grounds of the nature of your credit report, unless your credit profile is an inherent requirement of the job – in other words, if you are going to be employed in a position that requires trust and honesty and entails the handling of cash or finances.

Yes. It is important that you check your credit report regularly to ensure that the information is being reported to the Credit Bureau correctly. Also remember to use your credit report to detect any fraudulent activity against your record.

No, we do not penalize you for checking your credit score or your credit report on Up powered by Experian.

No. Potential credit providers will, however, be able to see how many enquiries other lenders have made on your profile, but nowhere will it say if the applications were unsuccessful.

Yes. Your free credit report will still show that you owed money and paid it off. The good news is that this will be seen as positive information, since your credit report will show that the account has been paid in full! If, however, you have not handled the account well, the historical bad repayment behaviour will be seen in a negative light. It is therefore important to always pay your creditors on time. The data retention period for accounts that are paid in full is 5 years after the last payment date. However, Experian’s free credit report will only show the information for three years after the last payment date.

No. Credit Bureaus are not credit providers, so they have no say in whether you are granted credit or not. However, the data provided by a Credit Bureau to potential credit providers will assist them credit providers in making that decision, which is why it is so important for you to understand what your credit report reflects as this is the data that will be assessed by potential credit providers.

Not necessarily. If you have a lot of debt, but you are managing it well, you will have a good credit score!. Your repayment history affects your free credit score and appears on your credit report. This means that if you have been a bad payer, your score will reflect this. The total amount of your credit does not usually affect the outcome of your credit score, since your credit score is mostly calculated according to your repayment actions and not necessarily by the amount you owe. Just be aware that if your revolving accounts and credit cards have a balance of 50% or more of the limit, the score could be affected.

If any of the information on your credit report is inaccurate or incorrect, you may log a dispute with Experian.

Allow 20 business days for Experian to resolve your dispute or query. During this time, Experian will contact the supplier of the disputed data for further information and evidence relating to the data. The information being disputed will be masked from display during the 20-business day investigation period and a notice to this effect is displayed on the credit report during this period to notify the reader that there is a dispute under way and that all the information is not reflected on the credit report. If, at the end of this period, Experian does not receive credible evidence from the supplier to support the data, the dispute will be resolved in your favour.

If any of the information on your credit report is inaccurate or incorrect you may log a dispute with Experian following the process:

Step 1:

Visit www.up.experian.co.za

Step 2:

Register and submit your dispute through the Up portal.

Step3:

Upload a copy of your ID and proof of address (no older than 3 months) and any supporting document (e.g. paid up letter)

If you need more information, you can also chat with Ed our chatbot.

Once all documentation is received, you will be supplied with an Experian reference number.

How to Log a Dispute

The National Credit Act (NCA) provides you with the right to dispute any factually incorrect information on your credit report generated by a Credit Bureau and to have this information corrected.

Logging a dispute with Experian is free of charge. Why pay one of the many “credit clearing companies” that charge money for doing something that you could do for free? Once you have logged a dispute with us, we have 20 business days to investigate the dispute.

In the event that you are not satisfied with the outcome of the dispute, you may refer the matter as follows:

Bank account information:

- Banking Ombudsman – 0860 800 900

- National Credit Regulator – 0860 627 627

Retail and other non-bank information:

- National Credit Regulator – 0860 627 627

Disputes Process Infographic

The disputes process can be confusing at times. To help you navigate the Experian disputes process, we've created this handy infographic.

Challenging your information with Experian

Experian holds consumer information; this information is used by financial services providers when performing a credit assessment and in some instances a score enquiry on consumers. We receive consumer data from financial services providers when consumers make an application or update their details with the service provider. We also receive payment information that reflects consumer payment behaviour, such as if they’ve made payments on time, have skipped payments or closed an account.

Dispute your Credit Report

Follow these easy steps

Step 1:

Visit www.up.experian.co.za

Step 2:

Register and submit your dispute through the portal.

Step3:

Upload a copy of your ID and proof of address (no older than 3 months) and any supporting document (e.g. paid up letter)

If you need more information, you can also chat with Ed our chatbot

Wise Up – Know your rights

The National Credit Act (NCA) gives you the right to apply for credit. All consumers must be treated equally in relation to one another when credit providers assess your application, determine rates/fees and compile and enforce the credit agreement.

You may ask the credit provider or bank to explain, in writing, their main reasons for:

- Refusing your application for a new loan/credit

- Refusing your application for an increased limit on existing loan/credit

- Refusing to renew a renewable loan/credit (such as a credit card)

- Offering a lower credit limit than the limit you applied for

- Reducing your existing credit limit

If your credit score or report was the main problem, the bank or credit provider has to disclose the name, address and contact details of the credit bureau that issued the report, so that you can get hold of your credit report to see what information on the credit report is keeping you from a successful application. Please note, your credit score and report are not the only factors lenders, banks and other credit providers look at when doing an assessment. The criteria they look at differs from company to company.

Credit information, credit reports and credit scores must be presented in a way that anyone can understand. To ensure that this happens, the bank or credit provider has to use plain language, simple sentence structures and uncomplicated graphics and illustrations to help you understand your credit application.

You have the right to maintain your confidentiality regarding your credit report. Unless you give permission, the banks, credit providers, and credit bureaus are not allowed to disclose your personal information to any other party, except when required by Law or court order.