Experian helps you build the most complete, accurate, consistent and holistic Single Customer View available today.

Learn more about the benefits of creating a single customer view in your organisation and the 4 steps we take to help you achieve it.

How could you benefit from an SCV?

83% of organisations see data as an integral part of forming a business strategy

Source - 2018 Global Data Management Research - Experian

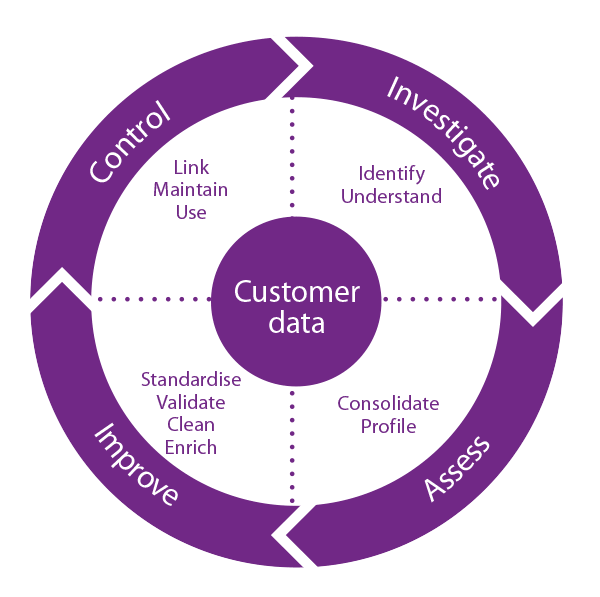

4 stages to achieving your Single Customer View

Our approach focuses on the data and provides a methodology that will consolidate, clean, fix, link, harmonise, and enrich with additional customer insights across all data assets within a business.

The 4 stages are:

Investigate - Extract data from systems across your organisation, consolidate it, and assess its accuracy and completeness as the first step to cleansing and validating.

Assess - Consolidate and profile the data so you can assess potential strengths and weaknesses within it, in the context of business priorities.

Improve - Bring consistency to the way your data is formatted, ensure your customer data is accurate, and fill the gaps using our unique range of reference data including location and socio-demographic data sets.

Control - Compare records, identify and harmonise duplicates, create a golden nominal and give each individual a unique identification number and ensure you can maintain an up-to-date and accurate view over time.